What Is PCI Compliance Consulting and Why Does Your Business Need It?

Understand PCI compliance consulting and its critical role in safeguarding your business. Explore why it's essential for protecting sensitive customer information.

In todays digitally-driven economy, businesses of all sizes are required to handle sensitive customer data, especially payment information. Ensuring that this data is securely managed is not just a best practiceits a necessity. This is wherePCI Compliance Consulting comes in.

Whether youre a small e-commerce business or a large enterprise with multiple retail locations, achieving and maintaining PCI DSS (Payment Card Industry Data Security Standard) compliance is crucial. Lets explore what PCI Compliance Consulting involves, and why its essential for protecting your business and customers.

What Is PCI Compliance?

PCI DSS is a set of security standards designed to ensure that all businesses that accept, process, store, or transmit credit card information maintain a secure environment. Compliance is not optional; failure to comply can result in heavy fines, security breaches, and loss of customer trust.

What Does PCI Compliance Consulting Include?

PCI Compliance Consulting services help your business understand and implement the necessary technical and procedural safeguards to meet PCI DSS standards. These services may include:

-

Risk Assessment & Gap Analysis

Identifying areas where your business may fall short of PCI requirements. -

Security Policy Development

Creating or enhancing your internal policies for handling cardholder data. -

Remediation Planning

Offering solutions to fix vulnerabilities before audits. -

Ongoing Monitoring & Auditing

Ensuring your systems remain compliant over time. -

Employee Training

Educating your team on secure data handling practices.

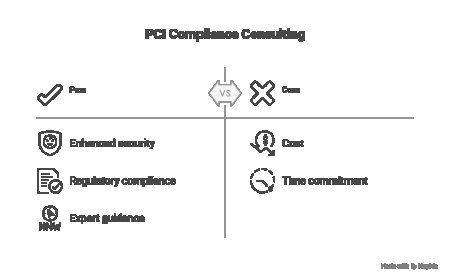

Why Your Business Needs PCI Compliance Consulting

1. Protect Customer Data

A breach of customer credit card information can be catastrophic. PCI compliance helps safeguard data from hackers and unauthorized access with advanced network security solutions.

2. Avoid Legal and Financial Penalties

Non-compliance can lead to hefty fines, lawsuits, and even loss of the ability to process card payments.

3. Boost Customer Confidence

When customers know youre serious about cybersecurity, their trustand loyaltyincreases.

4. Streamline Business Operations

Consulting helps businesses implement cybersecurity compliance solutions that improve operational security, reduce redundancies, and lower long-term costs.

5. Meet Industry Standards

With rising threats, having PCI compliance is often a prerequisite for doing business, especially when your operations are tied with other frameworks like GDPR Compliance Consulting or ISO 27001 Compliance Consulting.

PCI Compliance and Other Security Layers

To truly secure your infrastructure, PCI compliance should be part of a broader cybersecurity strategy. This includes:

-

Business Fiber Internet for faster, safer connections and better bandwidth control.

-

Commercial Perimeter Security Systems to protect physical access points.

-

Integration with ISO 27001 for complete information security management.

-

Adherence to GDPR when dealing with international clients and sensitive personal data.